Economic Blog

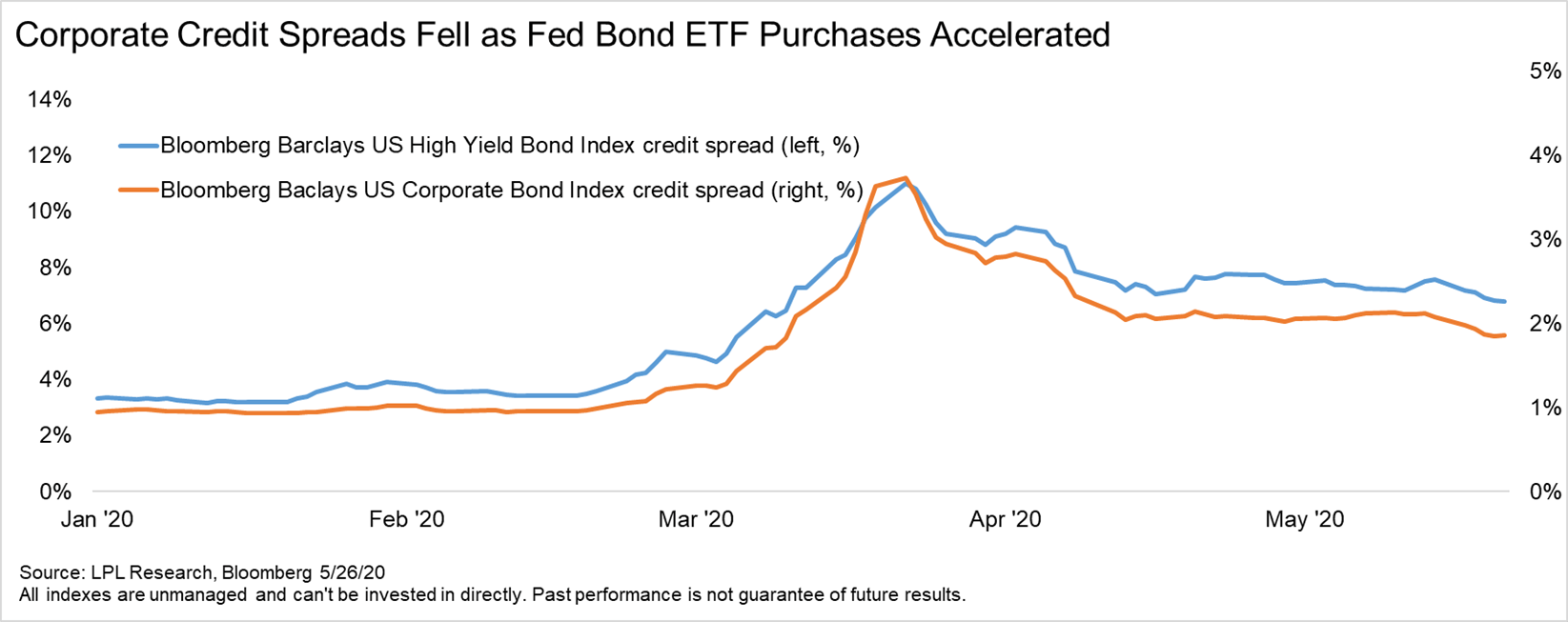

The Federal Reserve (Fed) increased its bond exchange-traded funds (ETF) purchases in the week ending May 20 (the most recent data available), adding another $1.5 billion in bond ETFs to its balance sheet, bringing the total holding to $1.8 billion. With Fed purchases accelerating, the average investment-grade corporate bond spread dipped below 2% last week for the first time since March 11. (Credit spreads reflect market participants’ perception of credit risk.) As shown in the LPL Chart of the Day, spreads had been largely flat for about a month following the initial declines off 2020 peaks despite stock market gains, but Fed buying may have been a catalyst for further compression.

“Buying ETFs is a new step for the Fed and is a convenient way for it to intervene in corporate bond markets,” said LPL Research Senior Market Strategist Ryan Detrick. “Once market participants believe the Fed is willing and able to add liquidity and relieve funding pressure through ETF purchases, the Fed will probably be able to get to the same place with fewer purchases. We expect purchases to decline unless market volatility picks up again.”

Spreads have already narrowed significantly since hitting 2020 peaks. The average high-yield spread is 66% of the way back to its 15-year median of 4.66%, while the investment-grade spread is 79% of the way back to its median of 1.36%. While valuations still lean attractive, spread compression may not be a major driver of returns looking forward, for investment-grade corporates. At the same time, investors’ greater caution with high-yield bonds makes sense, since they are more vulnerable if the economy doesn’t rebound as quickly as expected.

Investment-grade corporate returns may be back to “coupon clipping” environment where returns are driven by the income they generate rather than potential for price gains, especially if increases in Treasury yields offset further declines in credit spreads. Nevertheless, the relatively attractive average coupon of just below 4% still makes them a reasonable part of a diversified bond portfolio for suitable investors. The potential for high-yield spread compression still presents some upside for this riskier bond sector, but we remain concerned about vulnerability if markets become volatile again or if the pace of the economic recovery does not meet expectations, while also seeing more upside over the long term in stocks.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The credit spread is the yield the corporate bonds less the yield on comparable maturity Treasury debt. This is a market-based estimate of the amount of fear in the bond market. Base-rated bonds are the lowest quality bonds that are considered investment-grade, rather than high-yield. They best reflect the stresses across the quality spectrum.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use – Tracking 1-05014932